In an attempt to assess banks' capital needs, the U.S. government is testing how they would fare under more adverse economic conditions than are expected. The results are due at the end of April.

Once the "stress tests" are finalized and the capital needs are determined, banks will have six months to raise capital in the private market or could take an infusion of government funds.

The Obama administration is finding itself in a potentially no-win situation as it prepares to release details Friday about the methodology used in the tests, and at least partial results May 4. The so-called stress tests will determine whether the banks need more government bailout money and the $700-billion rescue fund needs to be replenished.

No banks will fail the test, administration officials have said, but the results will determine whether they have to raise more capital. If they can't do that in six months, the government will step in with funds to shore up operations at the banks, which are deemed too big to fail.

The Reuters/University of Michigan survey showed that U.S. consumers have more confidence in the economy than they have had since the sudden collapse of Lehman Brothers in September, the latest in a spate of data suggesting the economic slump may be easing.

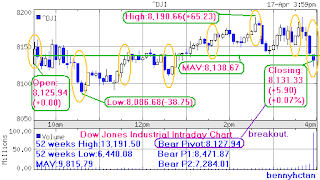

10:30am:--Gap fully covered,low with inverted bull hammer.

GE and Citigroup both posted better-than-expected results.

11:30am:--Ascending soldiers to near session high.

"The rate of deceleration in the economy is slowing," said David Lutz, managing director of trading at Stifel Nicolaus Capital Markets in Baltimore.

12:30noon:--Spike down with a bullish engulfing.

General Motors Corp. Chief Executive Fritz Henderson said Friday that a bankruptcy filing is "probable" because of the restructuring goals GM must meet to get more government loans, but that isn't the company's preferred option.

1:30pm:--Day's high breakout.

In a conference call with reporters, Henderson said GM is working on two parallel plans: one that involves bankruptcy and one that doesn't.It would need $4.6 billion in the quarter, and that hasn't changed, he said.

2:30pm:--Shooting star high.

Federal Reserve Chairman Ben Bernanke said that financial innovation is good for the economy but must be accompanied by proper regulation.

3:30pm:--The pullback to MAV.

An investment company run by the head of the Obama administration's auto task force has been accused of paying more than $1 million to an aide to New York's former comptroller in a bid to win a lucrative deal with the state pension fund.

4:00pm:--A bearish hammer below the MAV.

A cautious follow through of bears.

Friday's spinning top is covering the top portion of the candlestick.Any further pullback will be covering back the white bodies of Wednesday & Thursday candlestick..

Friday's spinning top is covering the top portion of the candlestick.Any further pullback will be covering back the white bodies of Wednesday & Thursday candlestick..Meanwhile we have to be resilient to such temporary pullback.

Votality swing today also due to Futures expiry.

We have penetrated to bull pivot and day's ahead will still be quite safe despite all the threatening speech by some of the hedge fund managers.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_special.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)