The Federal Reserve is increasingly confident in the economy and about to end a US$600 billion program to support it. Now for the next step - figuring out how to keep inflation from taking off.

Since late last year, the Fed has bought government bonds to keep interest rates low.

Fed Chairman Ben Bernanke and his colleagues are expected to signal this week that they will allow the program to expire as scheduled in June.

The end of the bond-buying program would mean that, aside from tax cuts, almost all the extraordinary measures the government took to prop up the economy are over.

Congress is fighting over how deeply to cut federal spending, not whether to spend more for stimulus.

Since the Fed announced the plan last August, worries that the economy would fall back into recession have all but disappeared. The private sector is adding jobs, and the stock market is at its highest point since the summer of 2008.

But higher oil and food prices pose a threat. If companies are forced to raise prices quickly to make up for escalating costs, that could start a spiral of inflation. Exactly how much of a threat inflation poses to the economy right now is a matter of disagreement within the central bank.

A vocal minority, including the Fed regional chiefs in Philadelphia and Minneapolis, believe the Fed may need to raise interest rates by the end of this year to fight inflation. The Fed has kept its benchmark interest rate near zero since December 2008.

And, Richard Fisher, president of the Federal Reserve Bank of Dallas, argues that the Fed has done its job and should consider halting the bond program now, not in June. "Now we at the Fed are nearing a tipping point," Fisher told reporters earlier this month, referring to inflation.

The majority - including Bernanke, vice chairwoman Janet Yellen and William Dudley, president of the Federal Reserve Bank of New York - believe interest rates should stay low longer, and the bond-buying program should run its course.

Bernanke has predicted that the jump in oil and food prices will cause only a brief, modest increase in consumer inflation. Excluding those prices, which tend to fluctuate sharply, inflation is still low, he has argued.

Bill Gross, who manages the world's largest mutual fund at Pimco, worries that rates on Treasury bonds will rise when the Fed stops buying them. If other buyers don't step in and there's less demand for Treasury bonds, then the rates, or yields, on those bonds would rise. That would drive down prices on bonds. Rates on mortgages, corporate debt and other loans pegged to the Treasury securities would rise, too. Higher borrowing costs could slow spending by people and businesses, and slow the overall economy.

Fed officials and others believe that because the end of the program has been well telegraphed, it won't have much of an impact on bond rates. That was the case in 2010 when the Fed ended a $1.7 trillion stimulus program.

The bond-buying program was the Fed's second since the recession, and is known as "quantitative easing," or "QE2" for short. The economy would have to be in serious danger of tipping into another recession for the Fed to consider embarking on a third round.

The Fed has other tools at its disposal. Since early August, it has taken about $17 billion a month that it earns in interest from mortgage-backed securities and used it to buy bonds, a separate and smaller step than the $600 billion program.

So far this year, Bernanke has managed to forge consensus for his policies - all Fed decisions this year have been unanimous - but the deepening divides could make Bernanke's job more difficult.

The decision comes at a time when Congress and the White House are fighting over how deeply they should cut federal spending over the next decade to curb the nation's budget deficit. The deficit is on track to be a record $1.5 trillion this year, marking the third straight year over $1 trillion. It's the highest share of the total economy since World War II.

House Republicans have passed a plan that would slash spending by nearly $6 trillion over the next decade, in part by overhauling Medicare and Medicaid. President Barack Obama wants $4 trillion in spending cuts over 12 years and would raise taxes on the wealthy.

The economic benefit of another major government measure meant to stimulate the economy, a $821 billion package passed in 2009 for building roads, repairing bridges and other infrastructure projects, has already rippled through the economy.

However, the economy is still getting support from a sweeping package of tax cuts, including a reduction in the Social Security payroll tax that will give an extra $1,000 to $2,000 to most households this year.

The Fed meeting begins Tuesday. When it ends on Wednesday, Bernanke, who wants to make the Fed more of an open institution, will take an unprecedented step for a Fed chief and hold a press conference.

The press conference gives Bernanke the chance to build support for the Fed. But it could also backfire if what he says causes confusion and rattles Wall Street.

Bernanke plans to conduct the press conference once a quarter to unveil the Fed's updated economic forecasts. The Fed is expected to lower its forecast for economic growth slightly this year, bump up its inflation estimate and upgrade its outlook for jobs.

Bernanke also is likely to use the press conference to emphasize the Fed's prediction that the jump in oil and food prices will lead to only a modest and short-lived increase in consumer prices. But he'll also stress that the Fed stands ready to act if inflation shows signs of taking off.

In February 2010, Bernanke began laying out the Fed's strategy for tightening credit. But the economy weakened in the spring and continued to struggle. Bernanke did an about-face, and the Fed announced the bond program during the summer.

The program was necessary in part because the Fed's key interest rate can't be cut any more to prop up the economy. Economists predict the Fed at this week's meeting will maintain a pledge to hold the rate where it is for an "extended period."

Dropping the pledge would be a signal that the Fed would soon be taking steps to tighten credit.

"The Fed isn't prepared to do that just yet. It would be an invitation for a rate-hike party," said economist Stuart Hoffman of PNC.

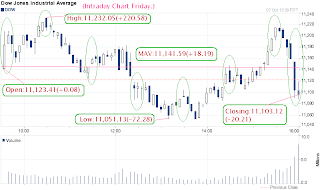

Tracking the Dow,Monday 25/4/11.

New Home Sales report.

Asian Index Futures expiry:29/4/11.

9:30am:--Bearish 20.0 points gap down.Oil price marches above $110.00 per barrel,inflationary pressure concern.

10:30am:--No signs of opening gap being filled,session with many bearish hangman near the low.

11:30am:--Weak ascending bulls finding a retracement for morning session.With no negative news hitting the tapes recently, the market is riding a wave of positive earnings.

12:30noon:--Hoovering near session MAV resistance line.

1:30pm:--The MAV resistance line breakout.Bullish spike.

2:30pm:--Bearish pullback hitting the MAV support.

3:30pm:--Last hour rebound.

4:00pm:--A weak inverted bull.

Wall Street wavered, oil slipped and the U.S. dollar weakened further against the euro in thin trading on Monday as major European markets were shut for Easter and the outlook for economic growth faltered.

With European markets closed and no major U.S. economic reports on the calendar, the two-day meeting of the Federal Open Market Committee that ends Wednesday will be the key event traders focus on to gauge the direction of monetary policy.

Tracking the Dow on Friday,07/10/11.Dow Futures is 10 market days to expiry.

Tracking the Dow on Friday,07/10/11.Dow Futures is 10 market days to expiry.

Despite a threatening Friday by another downgrade fixing the market,the Dow ended the first week with a bullish candlestick compared to last month which is bearish.The total trading range point to date is 827.58 points.

Despite a threatening Friday by another downgrade fixing the market,the Dow ended the first week with a bullish candlestick compared to last month which is bearish.The total trading range point to date is 827.58 points.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_special.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)