Investors were encourage by a rebound in consumer spending, which accounts for more than two-thirds of U.S. economic activity, and a decline in business inventories. On President Barack Obama's 100th day in office, the GDP report at least provided signs that the nation is seeing its economic slide start to moderate.

In a bull market, the market ignores bad news. Today, we ignored extremely bad news.

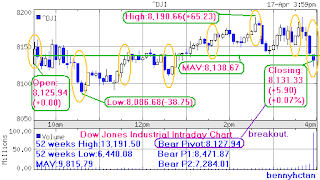

Tracking the Dow on Wednesday,29/04/09

Tracking the Dow on Wednesday,29/04/09

9:30am:--Bullish 80.0 points spike with an early spin pullback.

9:30am:--Bullish 80.0 points spike with an early spin pullback.

Tracking the Dow on Wednesday,29/04/09

Tracking the Dow on Wednesday,29/04/09 9:30am:--Bullish 80.0 points spike with an early spin pullback.

9:30am:--Bullish 80.0 points spike with an early spin pullback.First quarter GDP declined 6.1%, which is much worse than the 4.7% decline that was widely expected, but up slightly from the 6.3% drop that was experienced in the fourth quarter.

10:30am:--Bullish spin with spike up up session high.

The upbeat tone was undeterred by a worse-than-expected GDP reading, which showed that first quarter economic activity declined 6.1%. The consensus called for a 4.7% decline. However, news that personal consumption swung from a 4.3% decrease in the fourth quarter to a 2.2% increase in the first quarter has some participants feeling encouranged.

11:30am:--Bearish spin pullback as usual for lunch break.

Stocks have been trading with solid, broad-based gains for the entire session.

12:30noon:--An inverted bullish hammer noted.

Participants await the FOMC's latest policy directive (2:15 PM ET), which is expected to keep the target interest rate between 0.00% and 0.25%.

1;30pm:--Bulls still holding at session high.

The Fed said that household spending has seen signs of stabilization, but will continue to be pressured by job losses, decreased housing wealth and tight credit conditions.

2:30pm:--Bullish spike up on FOMC news.

The FOMC believe that inflation will remain subdued, with a risk of persistent inflation at levels below those that promote economic and price stability.

The vote to leave the fed funds rate and quantitative measures unchanged was unanimous.

The vote to leave the fed funds rate and quantitative measures unchanged was unanimous.

3:30pm:--The normal practice,pullback to day's MAV.

The DOE crude oil inventories report this morning revealed a build of over 4 million barrels.

4:00pm:--A breakway bull.

4:00pm:--A breakway bull.

Bullish follow through

The advance first quarter GDP report indicated that the U.S. economy fell 6.1% between January and March. A drop of 4.7% had been expected. Despite the ugly headline number, participants weren't deterred from bidding stocks higher.

The advance first quarter GDP report indicated that the U.S. economy fell 6.1% between January and March. A drop of 4.7% had been expected. Despite the ugly headline number, participants weren't deterred from bidding stocks higher.The Dow Index is now about at Pivot month peak and we are in a bear rally.

Any pullback in the next half month will be back to month's MAV.

The road is still bumpy ahead of banks stress test results.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_special.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)