Central Thailand was hard hit by the worst floods in 70 years.

Central Thailand was hard hit by the worst floods in 70 years.The abnormal heavy rainfalls in the Northern highlands caused the Mae Ping River(in Chiangmai) to swell and overflow into almost all low lying areas on its way out to the the Gulf of Thailand.

It was the night of September 28,2011 when the city of Chiangmai has a small effect of the flood.

There was no sign of warning when the flood water gushed into settlements in Nakhon Sawan during the night and within minutes reached as high as neck level.

Also affected were Ang Thong, Ayutthaya, Chai Nat, Chaiyaphum, Kalasin, Kampheang Phet, Khon Kaen, Lamphun, Lop Buri, Mae Hong Son, Mahasarakham, Nakhon Nayok, Nakhon Pathom, Nakhon Ratchasima, , Phichit, Phitsanulok, Prachin Buri, Saraburi, Sing Buri, Sukhothai, Suphan Buri, Ubon Ratchathani, and Uthai Thani.

Thsese seasonal weather phenomena has prompted Thailand considering to start trading of water derivatives, giving investors a means of hedging against disasters,the Securities and Exchange Commission said.

The regulator is studying the possibility of introducing contracts whose value would be linked to rainfall, or the level of water in the nation's major dams, said Vorapol Socatiyanurak, who started as secretary-general of the SEC in October. He declined to say when trading might begin.

Thailand is seeking to offer protection to investors in Southeast Asia's second-biggest economy after flooding in the central region killed almost 700 people and swamped about 1,500 industrial facilities. The waters may cause 1.3 trillion baht ($41.6 billion) of damage to the economy, prime minister Yingluck Shinawatra said on December 8. Intel Corp., the world's largest chipmaker, cut its revenue forecast this week as the floods disrupted personal-computer production.

"Flooding has become more frequent in Thailand, with much greater economic impact," Vorapol said in an interview in Bangkok . "The new security would offer investors, insurers and manufacturers an instrument to help alleviate financial losses in future catastrophes."

The contracts would also help protect farmers from the impact of floods and drought, Vorapol said.

The total face value of global weather-related derivatives grew by 20 percent between 2010 and 2011 to $11.8 billion, according to a May 20 report by the Washington DC-based Weather Risk Management Association. Demand growth was seen in contracts related to rainfall, snow, hurricanes and wind from industries such as agriculture, construction and transport, it said.

The majority of weather contracts are traded on the Chicago Mercantile Exchange. (CME) CME snow contracts, for example, are based on the exchange's Snowfall Index, a measure of average monthly snowfall in certain US cities. Traders "determine what amount of snowfall would be detrimental to their businesses and take futures or options positions based on that," the exchange said on its website.

"The new instrument is unlikely to help cover all exposure from water-related risk, but it's good to provide another alternative," said Sanya Harnpatanakitpanich, head of derivatives at Globlex Securities Co. Ltd, the nation's largest derivatives brokerage by trading volume. "The SEC and Stock Exchange of Thailand need major market makers such as foreign companies and domestic water utilities to assure the trading liquidity of water derivatives."

California-based Intel reduced its fourth-quarter revenue forecast on December 12 by about $1 billion, saying a shortage of hard-disk drives as a result of Thailand's floods is cutting customers' production of personal computers. Thailand is home to plants producing about a quarter of the world's hard-disk drives. Honda Motor Company and Toyota Motor Corporation also cut their profit estimates after the floods disrupted output.

Thailand's regulator also plans to relax rules to encourage bond sales by small and medium-sized companies whose access to investors may be hampered by low credit ratings, Vorapol said. Those issuers will probably be allowed to sell the bonds to some wealthy individuals, he said.

The SEC allows only Thai and foreign companies with investment-grade ratings to sell bonds to individual investors, he said. It may also allow more investment by mutual funds in bonds with credit ratings below investment grade, he said.

Vorapol, 56, was appointed the head of the regulatory agency for the nation's equity, bond and derivative markets in October. He has a doctorate from the University of Pennsylvania's Wharton School and was a lecturer at the National Institute of Development Administration, a state university.

Thailand's worst floods in half a century also destroyed millions of tons of crops and badly damaged industrial production.

The World Bank has estimated the damage at $45 billion and recovery and reconstruction needs at $25 billion. The National Social and Economic Development Board has slashed Thailand's economic growth forecast to 1.5 percent from 3.5 to 4 percent.

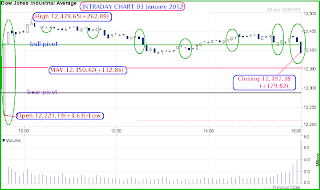

Tracking the Dow on the first day of trading year 2012.

Tracking the Dow on the first day of trading year 2012.Economic Indicators: ISM Manufacturing Index,Construction spending,FOMC Minutes.

Dow Futures expiry:13 market day to go.

Chinese New Year of the Dragon start on 23/01/12.

9:30am:--Bullish 180 points opening gap up.Traders back from the holidays in full force.Chinese manufacturing activities expanded in December also help the boost.

9:30am:--Bullish 180 points opening gap up.Traders back from the holidays in full force.Chinese manufacturing activities expanded in December also help the boost.10:30am:--After finding an early high,index is now drifting with many dojis.

Germany unemployment figures fall to new record low.

11:30am:--Dark clouds hanging preparing for mid-morning breather.Europe debt crisis still in the clouds.

12:30noon:--Thunderstorm pullback but still have the firepower despite holding on below the bull pivot support. The opening gap is too far off to be completely filled.

1:30 pm:--Mild retracement to the bull pivot resistance.Signs of improved growth in the United States,chances of Federal Reserve not printing more money.

2:30pm:--Bulls back in the limelight.British manufacturing also within expectations.

3:30pm:--Pullback to bull pivot support.Military exercise in the MiddleEast Gulf by Iran and U.S.naval vessels in the area put fear on confrontations.

4:00pm:--Bull pivot support breached,bearish fears.

One year chart of year 2011 with bi-monthly candlestick.

One year chart of year 2011 with bi-monthly candlestick.A year where the Eurozone create havoc to the world's financial markets.

January-Febrauary:- started with a weak inverted hammer bull.The Euro zone debt crisis still overhanging but there was agreement to revamp the European Financila Facilities.

Suddenly nature took its toll in Sendai,Japan with another fear of radiation contamination.

March-April:-Bullish spinning top.

Portugal 78 bullion euro bailout funds approved and this help the bullish sentiment ofthe month.

May-June:--Bearish hangman at session year high.

Months of Greece tussle that finally got its another 12 billion euro lifeline.Germany threatened to get rid of the pest out of Euro zone.

July -August:-Market crash.It was quite normal to see a crash around these months prior to the anniversary of Black Friday's October crash.

There is also a very strange phenomena that when the U.S.Federal Bankers meet in Jackson Hole fo their annual retreat,the market will crash badly prior to their meetings.

September -October:--High volatility months.

Annual corporate book closing about to begin.Window dressing with the help of the ratings companies upgrading and downgrading to fulfil their year end agenda of housecleaning so that they can laugh all the way to the bank.

November- December:--Bullish hammering of the bottom.

Enough damaged has been done to fool the financial markets with ratings and misleading Eurozone bailout signals.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_special.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)