Whatever the results appearing will be a yardstick for investors to gauge whether companies have been able to override the economic and political challenges of the past three months.

The sovereign debt default in Europe is still contagious but will sooner or later will be diagnose.

Also coming up week ahead is the September retail sales and October consumer sentiment reports that will determine the buying power of consumers.

The Federal Reserve will release minutes from its lat meeting,when it decided on a bond-swap program dubbed "Operation Twist."

So company earnings reports might overshadow whatever European negative news that are already a non-event but merely tricks.European banks will never be doomed.

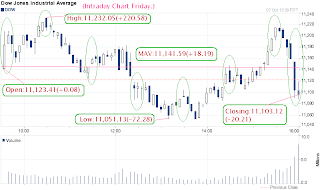

Tracking the Dow on Friday,07/10/11.Dow Futures is 10 market days to expiry.

Tracking the Dow on Friday,07/10/11.Dow Futures is 10 market days to expiry.Economic news: employment situation,Wholesale trade,consumer credit.

9:30am:--Bullish gap up.Employers adding more jobs.The follow through index shows a bearish hammer.

10:30am:--A retracement to session high with a bearish hammer.Consumer credit weakens.

11:30am:--The opening bullish gap has been completely covered.Bad new,another ratings company fixing the market.

12:30noon:--Consolidation time,hangman at morning low.Credit downgrades of Italy and Spain triggered this selling.

1:30pm:--A new session low with intermittent rebound,a graveyard doji hammering to double bottom.

2:30pm:--Time for economic news to save the market.Consumer spending rose at a slower pace due to drop in income.MAV resistance with a morning star.

3:30pm:--Hitting a double top of the day.

4:00pm:--Last minute panic selling.

Despite a threatening Friday by another downgrade fixing the market,the Dow ended the first week with a bullish candlestick compared to last month which is bearish.The total trading range point to date is 827.58 points.

Despite a threatening Friday by another downgrade fixing the market,the Dow ended the first week with a bullish candlestick compared to last month which is bearish.The total trading range point to date is 827.58 points.I'm just suspicious with all these ratings companies playing physician doctors at this time of the year where the annual financial book closing and window dressing are heating up.

We are at the beginning of the final quarter of the year.Normally most institution should have completed their sell down by September which is a yearly affairs.