Wall Street doesn't decide when a recession begins. That job is done by a rather obscure think tank called the National Bureau of Economic Research.

Here's how the NBER defines it: "A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales."

That's a lot to look at. Timing, as they say, is everything.

If the economy isn't slipping into a recession, it makes no sense to "stimulate" anything. Problem is, the NBER isn't exactly prompt in declaring a downturn. By its own admission, it takes six to 18 months after a recession has begun to declare that one has started. Way too long, in other words, to craft a meaningful policy response.

If the economy isn't slipping into a recession, it makes no sense to "stimulate" anything. Problem is, the NBER isn't exactly prompt in declaring a downturn. By its own admission, it takes six to 18 months after a recession has begun to declare that one has started. Way too long, in other words, to craft a meaningful policy response.

Based on these nasty developments -- along with soaring oil prices, crashing housing markets and gloomy consumers -- many are convinced we already are in a recession or soon will be. They include former Treasury Secretary Larry Summers, ex-Fed chief Alan Greenspan and a number of influential Wall Street investment houses.

For thee months in a row month, the Institute for Supply Management’s employment index has posted a reading below 50, which signals a contraction.The employment report is recessionary, but the manufacturing data shows expansion. "The market is highly conflicted."

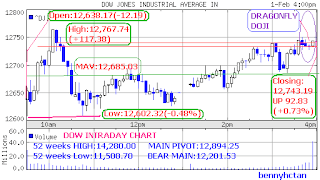

The morning session saw the major indices being booted down on the back of a surprisingly weak January jobs report.As usual,the pullback starts at 10:00am lasting for an-hour before it finds stability.

Stocks rallied Friday afternoon, gaining for a second session, as investors welcomed Microsoft's bid for Yahoo and more talk of a bailout for the troubled bond insurer sector.

At the closing bell,the pursuing bulls are still intact as seen by the dragonfly doji and a white body candlestick for the follow through the coming week.We are near the Main PIVOT and upon breakout,the Dow will be back on its feet in a bulls county.

The indices seems to be leaping upward from a downturn.Looks like this year February'08 which has an extra one-day to make it 29 days to form a LEAP-YEAR should augurs well for the Dow which started its 2008 index futures contract from its low point and as at 31/1/08 (MID-PIVOT-MONTH) and has peaked.

Friday's candlestick has lighted beyond the long upper shadow of Wednesday and is forming a new candlestick.